Many sales of fund shares occur through a retail broker-dealer.

That being said, we note that the application of the proposed broker-dealer SAR rule to transactions involving fund shares is not clear in all cases. The Application of the Proposed Rule to Transactions Involving Fund SharesĪs a policy matter, the Institute believes that it is reasonable and appropriate to subject transactions in fund shares to risk-based SAR requirements as part of an overall strategy for guarding against potential money laundering activity in the U.S. Some transfer agents prepare and mail statements confirming shareholder transactions and account balances, and maintain customer service departments to respond to shareholder inquiries. Transfer agents also may process transactions by accepting purchase payments and/or calculating and disbursing dividends and redemption proceeds. Transfer agents maintain records of shareholder accounts and prepare and mail shareholder account statements, federal income tax information, and other shareholder notices. Some fund transfer agents are banks or broker-dealers, but most are not. Transfer agents are registered as such under the Securities Exchange Act of 1934. Funds employ transfer agents to conduct recordkeeping and related functions. The underwriter is responsible for offering the fund’s shares, either directly to the public or through broker-dealers and other financial intermediaries. (NASD) rules governing mutual fund sales practices (although as discussed more fully below, the NASD’s suitability rules generally do not apply). Underwriters are registered as broker-dealers under the Securities Exchange Act of 1934 and are subject to National Association of Securities Dealers, Inc. For purposes of this letter, the terms “underwriter” and “fund underwriter” mean a broker-dealer engaged in underwriting securities issued by funds. All of their functions are carried out by affiliated and/or unaffiliated service providers. Funds typically have no employees of their own. 8įunds are legal entities formed pursuant to state law (most often as a corporation or business trust). We note that the BSA does not define the term “investment company.” In adopting anti-money laundering rules applicable to “investment companies,” Treasury may wish to consider specifying which entities it intends to cover. 7 It does not include the types of private investment companies commonly known as hedge funds.

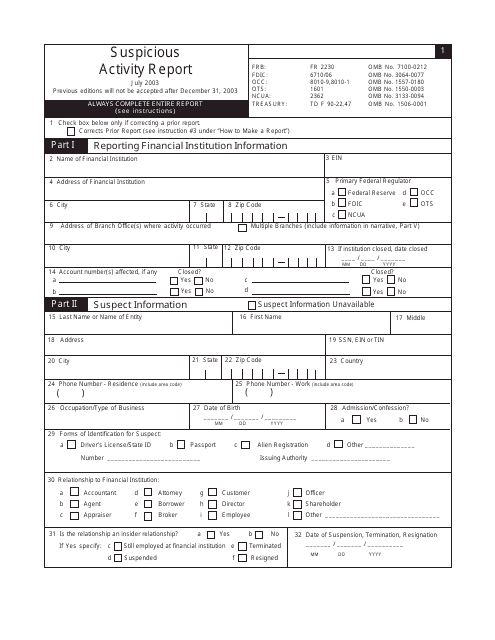

This includes open-end investment companies (commonly called mutual funds), 5 closed-end investment companies, 6 and unit investment trusts. We use the term “fund” in this letter to refer to any investment company that is registered under the Investment Company Act of 1940. Background-The Fund, Its Underwriter, and Its Transfer Agent Following this introductory section are our specific comments, which focus on four areas: (1) the application of the proposed rule to transactions involving fund shares (2) reportable transactions (3) the filing of suspicious activity reports by funds, fund underwriters, and/or fund transfer agents and (4) the delegation of Treasury’s authority to examine fund underwriters for compliance with the rule. To provide the context for our specific comments on the proposed rule, our letter begins with a brief description of the three main entities with which we are concerned-the fund, its underwriter, and its transfer agent.

We are commenting on this proposal because, as explained more fully below, transactions in fund shares 4 may be conducted by, at, or through the fund’s principal underwriter, which is a broker-dealer. In general, transactions would be reportable if they are conducted or attempted by, at, or through a broker-dealer involve or aggregate funds or other assets of at least $5,000 and involve any known or suspected violation of law or regulation, including a violation of Federal law, a suspicious transaction relating to money laundering, or a violation of the Bank Secrecy Act (BSA). The proposed rule would require all broker-dealers to report suspicious transactions to FinCEN. The Investment Company Institute 1 appreciates the opportunity to comment on the rule recently proposed by the Financial Crimes Enforcement Network (FinCEN) that would require brokers or dealers in securities (broker-dealers) to report suspicious transactions. Re: NPRM-Suspicious Transaction Reporting-Brokers or Dealers in Securities

0 kommentar(er)

0 kommentar(er)